Fitch Ratings reports “improving, more favorable” mid-year 2024 results for U.S. personal auto insurance companies will likely continue through the end of this year and into 2025.

Fitch listed several rounds of material price increases and a moderation of claims severity trends as reasons for “vastly improved” profit.

“However, a return to segment underwriting profitability could lead to a sudden flattening of price movement going forward,” Fitch wrote. “Improved underwriting performance will eventually lead to competitive pressure and resistance from policyholders and regulators for further price increases. Companies that are lagging in the turnaround of auto results, including several large mutual carriers, may face difficulty in taking needed pricing actions while also retaining policyholders in a more competitive environment.”

An extended period of better auto profits will help several companies affected by substantial profit deterioration in 2022 and 2023 restore capital adequacy to prior levels, Fitch added.

GAAP filings for nine publicly held auto insurers indicate that in the first half of 2024, the aggregate segment combined ratio (CR) decreased to 89%, compared to 100% during the first half of 2023 and 101% within the same period in 2022, according to Fitch.

Nearly all carriers in the group reported 10 points or better CR improvement year-over-year (YoY). Notably strong results include those made by Progressive Corp. (PGR; 87% segment CR) and GEICO (82%) — the nation’s second and third leading auto writers, Fitch said.

Out of the nine, only Hartford Financial Services Corp. and Cincinnati Financial Corp. reported segment CRs above 100% for 1H24, according to Fitch’s report.

“Personal auto loss severity trends are subsiding following over two years of sharp increases commencing in 2H21 [second half of 2021] from pandemic-related supply chain and labor market disruption,” Fitch wrote. “Higher general inflation has also greatly increased costs for auto parts and components, repairs, medical costs, and used vehicles.”

CCC Intelligent Solutions reported in June that cycle times and parts showed improvement during Q1 while labor and total repair costs continued upward.

The trends analysis was part of CCC’s Crash Course Q2 2024 report.

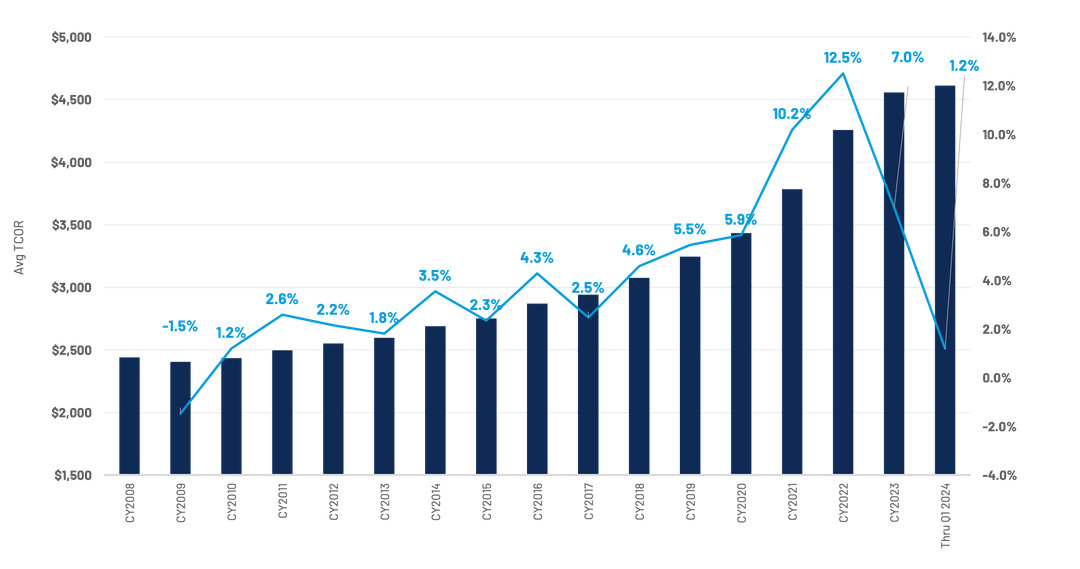

“The average TCOR for Q1 2024 currently stands at $4,611 — a 3.3% increase relative to Q1 2023 ($4,464),” the report states. “This increase may indicate that TCORs are beginning to fall back in line with inflationary trends.”

In its Q2 report, CCC said the average total cost of repair (TCOR) increased 3.3% in Q1 2024 compared to Q1 2023, with labor rates and parts costs contributing to the rise. Q1 2024 saw significant improvements in repair cycle times, with vehicles entering repair shops six days sooner compared to Q4 2023.

A new report from Insurify states that in the first half of this year, full-coverage annual insurance premiums were hiked another 15% to $2,329 on top of post-COVID increases over the past couple of years.

Insurify’s data science team projects a total 22% increase by the end of the year.

According to Fitch, PGR’s personal auto incurred severity dropped to 1% in 1H24 from 11% during the same period last year. GEICO’s loss severity on physical damage claims dropped 8-10% in 1H24 from 21-23% in 1H23.

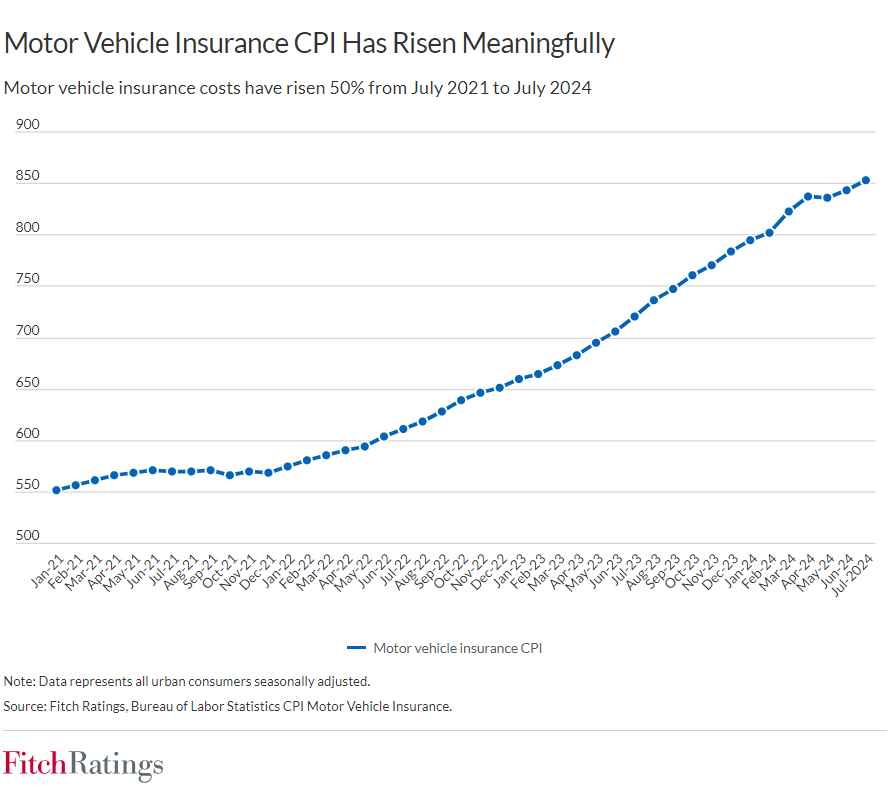

“Successive sharp increases in auto premium rates are the other key driver to recent underwriting improvement,” Fitch wrote. “According to CPI data, motor vehicle insurance costs have increased by 50% in total for the three-year period July 2021 to July 2024. Price increases showed slight signs of moderating with a 19% YoY increase in July 2024 versus a 22% change in March 2024.”

“Pricing actions fueled segment net written premium growth of 14% YoY for this group, including 22% for PGR,” Fitch said. “The company’s earlier return to strong profits versus peers positions it for near-term growth and a viable challenge to market leader State Farm for top segment market share in the next few years.”